FIRS E-Invoicing Compliance in Nigeria (2025 Update): Guaranteed Readiness with ASAERP

The new FIRS e-invoicing 2025 regulation makes digital invoicing mandatory for corporate taxpayers. This guide explains how ASAERP can help achieve FIRS readiness and full compliance.

The new FIRS e-invoicing 2025 regulation makes digital invoicing mandatory for corporate taxpayers. It’s a major shift requiring companies to connect their internal financial systems directly to the FIRS Merchant Buyer Solution (FIRSMBS). For business leaders, achieving compliance quickly and efficiently is paramount.

This guide explains the new rules, details the risks of non-compliance, and introduces ASAERP: a proudly Nigerian ERP solution designed to guarantee full FIRS readiness and simplify your financial operations.

Understanding the 2025 E-Invoicing Mandate

The National E-Invoicing Regime is part of a strategy to digitize tax administration, enhance efficiency, and reduce fraud nationwide. It routes transaction data through FIRS, aligning Nigeria with global best practices in tax oversight.

Who Must Comply?

The initial phase targets large taxpayers, defined as businesses with an annual turnover of ₦5 billion or more. The deadline for mandatory compliance is November 1, 2025. While this date only applies to large taxpayers, the rollout will eventually include all VAT-registered entities.

The FIRS Compliance Requirement: Pre-Clearance

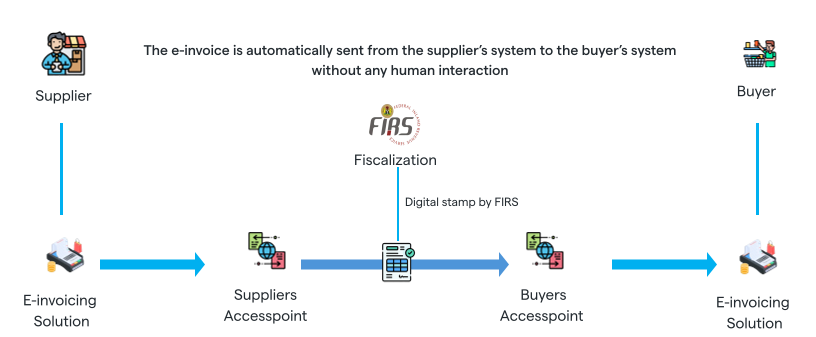

Nigeria has adopted a "pre-clearance" model for Business-to-Business (B2B) and Business-to-Government (B2G) transactions. This means your invoice cannot be legally issued to a customer until FIRS has approved ("cleared") it.

Required steps:

- Your system must submit the invoice data to the FIRS platform (FIRSMBS) in real-time.

- The invoice data must contain an Invoice Reference Number (IRN).

- The FIRSMBS platform validates the submitted invoice data.

- Only then can the validated invoice be issued to the recipient.

- Updates to the transaction (paid or rejected) should be submitted to the FIRSMBS platform using the IRN as the identifier.

Business-to-Consumer (B2C) invoices, on the other hand, do not require pre-clearance from the FIRS. However, these invoices must be reported to the FIRS within 24 hours of issuance. This process makes system integration a business continuity requirement, not just an accounting task.

Source: Diagram illustrating FIRS Merchant Buyer Solution (FIRSMBS) e-Invoicing Use Cases (Federal Inland Revenue Service, n.d.).

Retrieved from https://einvoice.firs.gov.ng/use-cases.

Navigating Technical Specifications: What Businesses Need to Know

Achieving compliance means your invoicing system must "talk" directly to the FIRS MBS platform. This connection is protected using digital certificates issued by FIRS.

Critically, the invoice data must be submitted in a structured, machine-readable format. Nigeria has adopted the Universal Business Language (UBL) schema, an international standard. This mandates that your system accurately map business data to 55 fields. These fields cover everything from unique invoice numbers to product codes and detailed tax calculations.

Any failure to map these 55 mandatory fields correctly results in an immediate validation error and rejection by FIRS, halting your ability to issue a legal invoice and seek payment.

The Role of Accredited Service Providers

To ensure secure and compliant integration, businesses must work with entities accredited by the National Information Technology Development Agency (NITDA). The FIRS ecosystem utilizes two main types of providers :

- System Integrators (SIs): Firms assisting businesses with ERP integration, managing the complex internal data mapping, applying the FIRS digital certificate, and preparing the structured data payload.

- Access Point Providers (APPs): Entities facilitating the validation and final secure transmission of the invoice to the FIRS platform.

Connecting to Your System Integrator

For a business to link up with a System Integrator, it follows a formal authorization process. First, the taxpayer must be registered and 'enabled' for e-invoicing on the FIRS platform. During this process, FIRS issues essential digital credentials, specifically the Entity ID and a secure Cryptographic Key File.

To onboard the SI, the business provides these keys to the selected accredited partner. This effectively grants ASAERP the digital authority to securely connect the company's internal ERP data (the 55 mandatory fields) directly to the FIRSMBS, managing all the technical integration and secure transmission on behalf of the client. Taxpayers are provided with a list of certified providers by FIRS and are free to change their provider if necessary. ASAERP functions at the System Integrator layer and ensures clients connect seamlessly with accredited FIRS channels.

Choosing The Right e-Invoicing Solution

Choosing the right e-invoicing solution can make or break your business. Foreign ERPs do not natively support the FIRS requirements and rely on expensive, custom middleware to bridge the gap. This reliance introduces technical instability and high integration costs. On the other hand, ASAERP is a proudly Nigerian ERP solution, offering native, out-of-the-box compliance.

By eliminating this middleware, ASAERP simplifies implementation and reduces costs. As an indigenous solution, ASAERP ensures rapid responsiveness to FIRS regulatory updates and platform changes. ASAERP's architecture is explicitly designed to handle the complex FIRS API requirements within the core ERP environment, positioning it as the first Nigerian ERP solution to offer this seamless integration.

ASAERP’s Promise: Guaranteed FIRS Compliance

ASAERP has strategically invested to ensure its platform is fully compliant with all FIRS e-invoicing requirements from the mandatory commencement date of November 1, 2025. ASAERP seamlessly manages:

- Full E-Invoice Compliance: ASAERP’s e-invoicing solution ensures full compliance for various sales and purchase transactions, including Commercial invoice, Credit/Debit Note, and Self-billed invoices, and more. The e-invoicing solution also handles payment updates.

- Robust Invoicing Solution: ASAERP comes with a robust invoicing solution that’s invaluable for industries, e.g, Oil & Gas, with complex invoice structures and formats.

- Quick Integration: Integrating the e-invoicing Solution with your ASAERP instance takes less than 5 minutes; all you need to provide are the credentials obtained from the FIRSMBS platform.

- Data Consistency: It ensures all 55 mandatory fields are correctly populated across your finance, inventory, and sales modules.

- Secure Transmission: It securely transmits the structured data payload via accredited FIRS channels, ensuring real-time validation and retrieval of the IRN.

Automation Excellence: ASAPay for Seamless Reconciliation

Compliance guarantees business continuity, but ASAERP also delivers superior efficiency through its advanced payment solution, ASAPay. Even with FIRS-cleared invoices, matching incoming bank payments against invoices (known as bank-ledger reconciliation) is often a time-consuming, manual process. This tedious task is prone to errors from partial payments, bank fees, or vague references, slowing down the financial close.

ASAPay is ASAERP’s proprietary automation feature that tightly integrates real-time payment acceptance and disbursements within the core ERP.

With ASAPay, your banks and books are always in sync!

ASAPay utilizes intelligent rules to compare bank transactions with outstanding invoice records instantly. This results in:

- Real-time bank reconciliation

- Faster Financial Close

- Reduced Errors

- Audit Confidence

This is perfect for industries like Retail (Supermarkets, Fuel or Gas Stations, etc), Trade & Distribution, Fast-Moving Consumer Goods, as they typically deal with high volumes of sales. To learn more about ASAPay, you can read more here.

Parting Words

The FIRS E-Invoicing mandate is a legal certainty you must meet by November 1, 2025. Choosing an integrated platform is essential for Nigerian businesses. Global solutions offer complexity; ASAERP offers native reliability.

ASAERP is proudly the first Nigerian ERP solution that offers out-of-the-box integration with the FIRSMBS platform, guaranteeing full compliance with all technical requirements of FIRS e-invoicing 2025. Furthermore, ASAERP delivers unmatched operational velocity through ASAPay, automating reconciliation and delivering stressless financial control.

Don't let the November 1st deadline become a penalty risk.

Take Control of Your Compliance and Financial Future with ASAERP.

Schedule a demo today to see how ASAERP guarantees your compliance with FIRS e-invoicing requirements and delivers smarter, automated financial management.

Team ASAERP

ASAERP is a leading Nigerian Cloud ERP. Seamlessly monitor and manage all your business operations from anywhere in the world with our unified platform.

No comments yet. Login to start a new discussion Start a new discussion